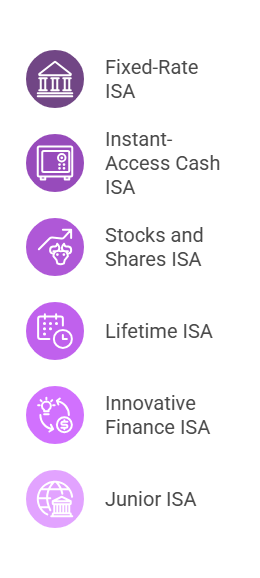

If you want to save money and plan for the future, an Individual Savings Account (ISA) can be beneficial. Fixed-Rate ISAs are one of the most popular options available in the UK, offering stability and guaranteed returns.

However, with so many ISAs to choose between, it’s only natural to wonder whether a fixed-rate option suits your needs. In this guide, we’ll explore some alternatives to Fixed-Rate ISAs so you can make the best decision for your needs.

What is a Fixed-Rate ISA?

A Fixed-Rate ISA lets you lock your money away for a set term, helping you reach savings goals and avoid temptation. These accounts offer tax-free interest on savings of up to £20,000 (the 2024/25 allowance).

In return for locking your money away for an agreed-upon term, you’ll receive a guaranteed interest rate. This makes it easy to plan for your future. These interest rates are often higher than with other savings accounts, as you’re locking your money in.

It’s also important to remember that there are different types of Fixed-Rate Cash ISA available, including:

| Fixed-Rate Cash ISA Type | Features | Best For |

|---|---|---|

| 1-Year Fixed-Rate ISA | Allows you to lock your money into the account for one year – some ISAs let you withdraw money early for a fee. | People with short-term savings goals. |

| 2-Year Fixed-Rate ISA | Requires you to lock the money in for two years, but offers slightly higher interest rates. | People who want higher interest in return for locking their money in for an extra year. |

| 3-Year Fixed-Rate ISA | Offers higher interest rates due to the longer lock-in period, but the withdrawal fees are often higher. | People with longer term savings goals who still want some flexibility. |

| 5-Year Fixed-Rate ISA | Your money will be locked in for five years, but you’ll get higher interest rates. | People with long term savings goals, such as planning for retirement. |

Using an ISA Calculator can help you determine which is the best option for your needs.

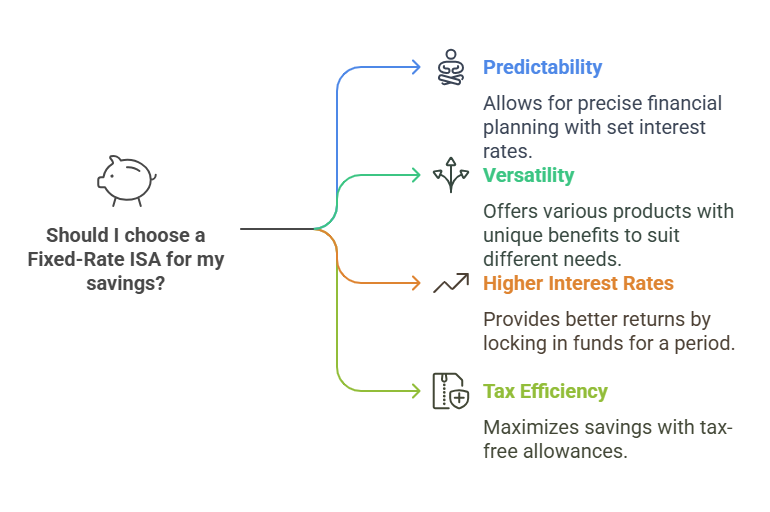

The benefits of Fixed-Rate ISAs

Regardless of the term you choose, fixed-rate ISAs offer multiple benefits, making them a popular choice for a variety of savings goals.

Predictability

Fixed-rate ISAs are predictable because they come with set interest rates, so you can plan your financial future. Being able to calculate the returns also means you know how much you’ll need to put away for a specific goal.

Versatility

Due to their popularity, plenty of Fixed-Rate Cash ISA products are available, each offering unique benefits. For example, you might find an account offering higher interest rates if you deposit a certain amount or providers with low initial deposit thresholds.

Higher interest rates

While there’s less flexibility with a Fixed-Rate Cash ISA, you’ll get higher interest rates in return. Agreeing to lock in your money for a pre-determined period gives you a better return on your initial investment.

Tax efficient

The main benefit of all ISAs is the tax-free allowance. As long as you stay within the £20,000 limit during the tax year, you won’t need to worry about capital gains or income tax, ensuring you can maximise your savings.

Potential drawbacks

As with all financial products, Fixed-Rate ISAs have some drawbacks. While they’re not dealbreakers, it’s important to weigh the pros and cons before making a decision. Let’s examine them.

Limited flexibility

These ISAs are for people willing to lock their money into the account for a set term. If you’re looking for flexibility, exploring other options with low or no withdrawal fees might be best. You should also consider whether you have access to another savings account for emergencies.

The market might improve

Most Fixed-Rate ISAs come with predictable interest rates, which can be beneficial. However, this also means you might miss out on better rates should market conditions change. It’s really a matter of whether you’d prefer predictability or are willing to take risks.

The alternatives to Fixed-Rate Cash ISAs

If you’re unsure whether a Fixed-Rate ISA suits your needs, plenty of alternatives will let you maximise your personal savings allowance. From flexible accounts that let you access money whenever you want to investment-focused savings, you’ll find a suitable option.

Instant Access Cash ISA

As the name suggests, an instant access account gives you more flexibility. You can make withdrawals as and when needed in most cases.

It’s important to remember that each ISA provider is different. While some offer unlimited withdrawals, others might offer a maximum of three over a set period.

The account you choose will determine your interest rates, and some providers might charge fees if you exceed the number of allowed withdrawals.

The benefits of Instant Access ISAs:

- Flexibility: You can boost your savings while still enjoying flexibility in withdrawals. Having easy access to the account is beneficial if you want to use it for emergencies.

- Versatility: These accounts are often easy to open and manage. Unlike some fixed accounts where a minimum deposit applies, you can open an Instant Access ISA with limited funds.

- Interest Rates: Compared to traditional savings accounts, they often have higher interest rates, allowing you to maximise your return.

Potential drawbacks:

- Limited Growth: If you want to grow your savings long-term, opting for a Fixed-Rate ISA might be more beneficial, as they’re best for financial planning.

- Lower Interest Rates: When you opt for an Instant Access ISA, you’re trading flexibility for interest. These accounts often have lower interest rates and might decrease further when you withdraw money.

Stocks and Shares ISA

A Stocks and Shares ISA is one of the most popular Investment ISA types. These accounts enable you to invest in a variety of products, including stocks, shares, bonds, gilts and ETFs (depending on the provider you choose).

You can use your £20,000 tax-free savings allowance to invest and won’t pay income tax or capital gains on your returns, making these ISAs ideal for people willing to take on more risk.

However, the stock market can be volatile, and you cannot guarantee that you will reach your savings goals.

The benefits of Stocks and Shares ISAs:

- Flexibility: You can choose the type of stocks and shares you invest in or opt for a managed account, including a set investment portfolio. This means that a Stocks and Shares ISA can also suit beginners.

- Potential Returns: Making wise investments can result in significant returns. While interest rates rarely rise with Fixed ISAs, Stocks and Shares ISA accounts let you diversify your investment portfolio.

- Tax-Free: As long as you don’t exceed your annual ISA allowance, you won’t have to pay tax on your returns.

Potential drawbacks:

- Risks: As with any investment account, there’s always the risk of losing money. If you have no other savings to fall back on, a Stocks and Shares ISA might not be the best decision.

- They’re Long Term: While there’s nothing to say you can’t use a Stocks and Shares ISA for short-term savings, they offer the best possible returns as long-term investments.

Lifetime ISAs

Lifetime ISAs are popular products for people with long-term savings goals, such as retirement or saving for a property deposit. Unlike most ISA products, a Lifetime ISA has a maximum deposit allowance of £4,000 yearly, but the government will give you a 25% annual bonus – up to £1,000.

As long as you’re aged between 18 and 40, you can open a LISA and gradually accumulate money for your savings goals. While these ISAs are highly popular, they’re best as longer-term accounts.

If you’re saving for your first home or want to enjoy your retirement, LISAs are ideal. You can also choose between Cash LISAs or Stocks and Shares LISAs.

The benefits of Lifetime ISAs:

- Bonuses: You’ll receive a 25% bonus each year from the government. For example, saving £2,000 is an extra £500 towards your savings goals.

- Low-Risk: Like fixed-rate savings accounts, Cash LISAs come with low risks, as you’re not reliable in the stock market.

- Flexibility: You can use the LISA to purchase your first home or build a retirement fund.

Potential drawbacks:

- Penalties: You’ll need to pay a fee if you withdraw your funds for something other than buying a home or your retirement.

- Risks: Opting for a Stocks and Shares LISA means taking on extra risks, as there’s no guarantee that you’ll secure a positive ROI.

Innovative Finance ISA

Innovative Finance Individual Savings Accounts can be beneficial if you’re looking for a unique ISA product. These accounts let you fund loans and investments to small companies, individuals, and other entities instead of traditional stocks and shares.

The interest you accumulate on these loans is tax-free, which means you can potentially boost your savings account and enjoy high returns. Of course, these accounts also come with some risks, and it’s important to understand the potential losses before lending money.

The benefits of Innovative Finance ISAs:

- Diversity: Depending on the company you open an account with, you can lend money to a variety of entities, boosting your chances of securing high returns.

- Flexibility: Many ISA providers also let you choose a degree of risk, with high-risk P2P lending accounts reserved for those willing to take more chances.

- Interest Rates: Depending on your risk level, you could receive interest rates of up to 15% and even higher in some cases.

Potential drawbacks:

- Risks: It’s vital to remember that P2P lending can be unpredictable, and there’s always a risk of losing money.

- Complexity: If you’re new to investing and ISAs, you might find these accounts too technical to understand, restricting your potential returns.

Junior ISAs

If you have a child, saving for their future is probably a significant priority. Junior ISA accounts let you put money aside and ensure your child receives financial support when they age.

As with other ISAs, you can save money without worrying about paying any tax, making these products a great way to maximise your child’s savings.

In most cases, the child can withdraw money from the ISA when they turn 18, and different products are available. For example, you could open a Junior Stocks and Shares ISA or Cash ISA.

The benefits of Junior ISAs:

- High Deposits: With a Junior ISA, you can deposit up to £9,000 each year, which means your child will receive a healthy cash injection when they come of age.

- Diversity: You can choose between traditional Cash ISAs or Stocks and Shares ISAs.

Flexibility: Once the child turns 18, they’ll be able to access the money.

Potential drawbacks:

- Limited Access: While many parents would agree that restricted access is a positive aspect of Junior ISAs, you’ll also need to consider whether your child might need to access their account early.

- Risks: Opting for a Junior Investment ISA can pose some risks, as your investments can change.

Which ISA suits your needs?

As you can see, multiple ISAs are available, and the one you choose should meet your savings objectives. While Fixed-Rate ISAs are popular products, they’re not for everyone. For example, if you’re comfortable with investing or would like to take more risks, Stocks and Shares ISAs might be best.

Lifetime ISAs are a fantastic option for long-term savings, but they have a lower allowance and won’t offer instant access,

If you want to explore ISA products, please use our convenient tool. With a vast selection of ISAs and providers available, you can simplify your search today..