With increased living costs and a competitive property market, reaching your financial goals can seem like a never-ending struggle. Putting your money into an Individual Savings Account (ISA) is a tax-efficient way to maximise your finances.

Whether you’re planning on buying your first home, building an emergency nest egg or want to enjoy tax-free investing, there’s an ISA that suits your needs. However, with so many ISA accounts available, you’ll need to consider which is best for your immediate and long-term financial objectives.

In this guide we’ll cover:

- The different types of ISAs

- How to choose one that’s right for your needs

What are the different types of ISAs?

There are multiple types of Individual Savings Accounts available, each with unique benefits. The one you choose should align with your savings goals and the level of risk you’re comfortable with. Let’s explore each ISA type.

Cash ISAs

A Cash ISA is ideal if you want a low-risk savings account that gives you a predictable return on investment. You can save money each year without paying any interest or income tax, making these ISAs ideal for short-term savings or building an emergency fund.

There are two types of Cash ISAs available:

- Fixed-Rate: A fixed-rate Cash ISA offers guaranteed interest rates on your savings, making it easier to plan for the future.

- Variable Rate: Variable-rate ISAs are popular options for people who are willing to take on some risk for potentially higher interest rates.

In most cases, a fixed-rate ISA means you’ll need to lock the money into your account for a set time and will face a penalty if you want to withdraw funds. Variable ISAs are usually more flexible, but your interest rates might decrease if you withdraw money.

View Cash ISAs

Investment ISAs

Investment ISAs are innovative financial products that enable you to invest money in bonds, shares, stocks, funds, and investment trusts. Account holders can invest up to £20,000 annually and enjoy tax-free investment growth, resulting in higher returns.

While Investment ISAs are popular, they also come with more risks than Cash ISAs, as market conditions can change. The most popular types of Investment ISAs include:

- Stocks and Shares ISAs: Opting for a Stocks and Shares ISA lets you invest in the stock market, potentially securing higher returns. However, these ISAs also come with more risks.

- Innovative Finance ISAs (IFISAs) Allow investment in peer-to-peer lending. They offer higher interest rates but less security than Cash ISAs.

- Ready-made Portfolios: If you’re new to investment, opting for a ready-made portfolio means you can maximise your annual ISA allowance but take on fewer risks, as a specialist puts it together based on different risk levels.

View Investment ISAs

Lifetime ISAs

Lifetime ISAs are available for people aged between 18 and 39 – but people with an existing account can still use it after turning 40. LISAs help you save for the future, including purchasing your first home or planning for retirement.

The unique benefit of these accounts is that the government adds a 25% bonus each year on the amount you save. With a maximum annual investment of £4,000, you could receive £1,000 each year, which will go towards a deposit or boost your retirement fund.

As LISAs are long-term accounts, many providers have penalties for withdrawing money, but they’re great ways to plan for the future.

View Lifetime ISAs

Junior ISAs

If you want to plan for your child’s future, opening a Junior ISA is a great way to invest on their behalf. The annual ISA allowance for junior accounts is £9,000 annually, and the funds will remain locked until your child turns 18.

Opting for a Cash ISA offers tax-free interest, while Junior Stocks and Shares ISAs are an investment opportunity. You can also choose between self-invested options or ready-made portfolios.

View Junior ISAs

Comparing ISA types

| Type of ISA | Description | Options/Features | Additional Notes |

|---|---|---|---|

| Cash ISAs | Low-risk savings accounts with predictable returns. Ideal for short-term savings or building an emergency fund. | – Fixed-Rate: Guaranteed interest rates; money locked for a set time with withdrawal penalties.

– Variable Rate: Flexible but interest rates may decrease with withdrawals. |

Interest or income tax-free. |

| Investment ISAs | Allows investments in bonds, shares, stocks, funds, and trusts. Offers tax-free investment growth with higher potential returns but greater risk due to market fluctuations. | – Stocks and Shares ISAs: Invest in the stock market for higher returns but with increased risk.

– Innovative Finance ISAs (IFISAs): Peer-to-peer lending with higher interest but less security. – Ready Made Portfolios: Managed investments for reduced risk. |

Annual investment limit of £20,000. |

| Lifetime ISAs | Designed for people aged 18-39 (usable after age 40 if opened earlier). Helps save for a first home or retirement with a government bonus. | – Government adds a 25% bonus annually on savings.

– Maximum annual investment: £4,000, with up to £1,000 in bonus funds. |

Withdrawal penalties may apply; suitable for long-term planning. |

| Junior ISAs | Accounts to save for a child’s future. Funds are locked until the child turns 18. | – Cash ISAs: Tax-free interest.

– Junior Stocks and Shares ISAs: Investment options available as self-invested or ready-made portfolios. |

Annual allowance: £9,000. |

How to choose the right ISA for your needs

Unlike traditional savings accounts, you can secure higher returns on an ISA, but choosing the right tax-free savings account for your needs involves weighing each option against your immediate and long-term financial objectives.

Savings goals

Most people open ISAs to save for the future, but it’s important to consider whether you have short—or long-term objectives. If you want to put extra money aside for emergencies, an Instant Access Cash ISA can be beneficial as it offers more flexibility.

Lifetime ISAs are best when saving for a home or planning your retirement, while Junior ISAs let parents put money aside for their child’s future.

Risk tolerance

Cash and lifetime accounts are best if you’d prefer an ISA that gives you predictable ROIs. However, if you’re willing to take on some degree of risk and want to secure potentially higher returns, Investment ISAs can deliver.

You can also minimise risks by opting for a managed portfolio, but there’s still the chance that you’ll lose money.

Existing ISAs

While the previous rules restricted the number of ISAs per person, these laws changed in 2024, and it’s now possible to open multiple ISAs in the same tax year. However, you can’t exceed the £20,000 annual ISA allowance.

So, if you already have a Fixed Rate Cash ISA, it’s worth considering whether a Stocks and Shares ISA will let you diversify your potential returns and increase your savings.

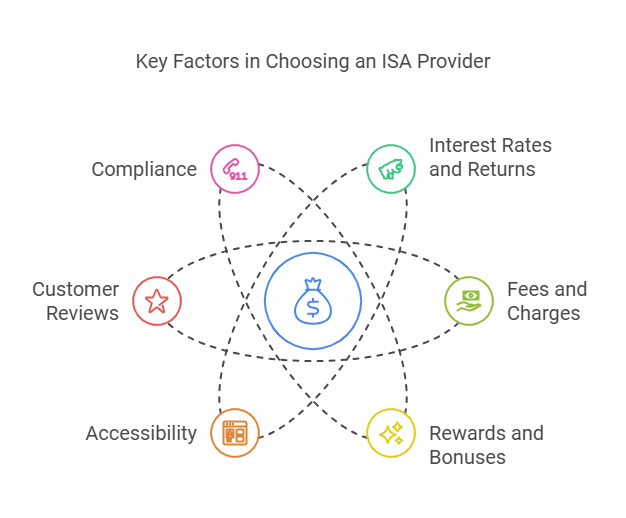

Choosing an ISA provider

Rates and potential returns

All ISA providers are different, and it’s worth exploring the interest rates and potential returns before making a decision. When comparing Cash ISAs, look at the rates available and see which offers the best deals.

Stocks and Shares ISAs often require more research, as you’ll need to evaluate the historical performance of different investment trusts.

Fees and charges

ISA fees can impact your immediate and long-term returns. Carefully assess each ISA provider’s fees, including transaction costs, management fees and withdrawal charges.

While some companies charge flat fees, others might charge based on the size of your account and how often you make transactions.

Rewards and bonuses

When comparing ISA providers, you’ll notice that some offer bonus rates and other features. For example, when you open an account and invest a certain amount, you might receive higher interest rates for a set amount of time.

Others might offer ethical ISAs, which ensure you only invest in socially responsible funds. Assessing available features will help you decide which provider offers the most benefits.

Accessibility

Opting for an online account is probably best if you want 24/7 access to your ISA. However, some people prefer to make transactions in person, and popular banks might offer Branch Only ISAs. Remember to look at the ISA provider’s app or website to assess its features.

Transfer flexibility is another vital consideration, as there might come a time when you want to transfer your ISA to another account. Ask about the provider’s transfer policy and evaluate potential charges before deciding.

Customer reviews

Customer reviews can tell you a lot about an ISA provider, including whether they offer the latest products and if the customer support is reliable. Instead of just looking at the website or app, you can use review platforms like Trustpilot to determine whether the company is reputable.

This is especially important for Stocks and Shares ISAs, as you’ll want to ensure that the ready-made portfolios are managed by experts.

Compliance

Always make sure that an ISA provider is fully compliant with the laws. Check that it’s regulated by the Financial Conduct Authority (FCA) and ensure any funds are protected under the Financial Services Compensation Scheme (FSCS).

The FSCS ensures financial security if the provider becomes insolvent, with guarantees of up to £85,000.

Compare ISA providers today

Whether you want a cash ISA or an investment ISA or are planning for the future with a LISA, comparing providers ensures you get the best possible rates and ROI. Our website is your go-to resource for comparing ISAs and finding the best option for your needs.

With multiple ISA types and numerous providers, you can discover great rates and simplify your search.

Compare ISA Providers